Preparing for What Life Can Throw at You

Seniors Learn How to Manage Their Finances on a Credit to Life Field Trip

May 1, 2018

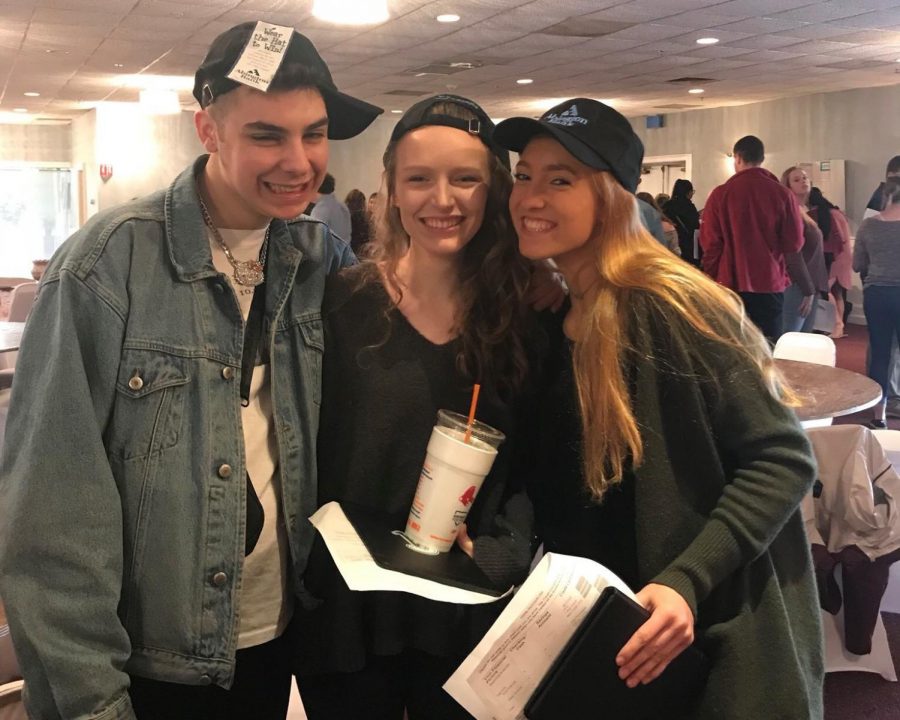

On Wednesday April 25 Abington High School Seniors had the opportunity to participate in the Credit for Life Fair. Students went to Emerald Hall in Abington where they were assigned a career and given a salary, credit score, and savings account with a random amount in it. Students were to create budgets to ensure they had enough money to get by.

This field trip was organized by health teacher Ms. Daisy and business teacher Ms. Howell. Ms. Howell recommends the field trip as it allows students to practice budgeting in a fun manner. Most importantly, she said, “It also gives you an understanding of how much life actually costs!”

The field trip brought to life things, such as credit and budgets, that students learned about in their personal finance and senior seminar classes.

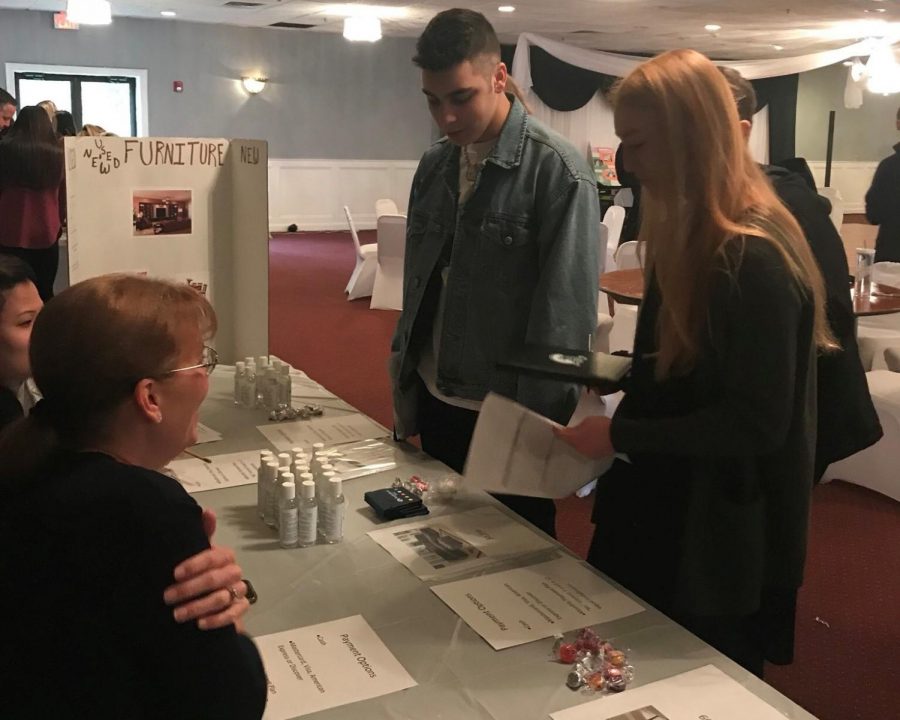

There were several booths around the hall that represented the different costs students will soon experience as adults. The booths included transportation, housing, clothing, health and nutrition, and insurance. The booths were run by people who work at banks, insurance companies, or as realtors. The advice these professionals was able to offer due to their specialized careers in financing was extremely helpful.

On top of this, they have also gone through these experiences in their own life making them valuable resources for students learning about managing their money.

There were also booths like the luxury and reality check booths that made the project more lifelike. The luxury booth allowed people to splurge on big items like a vacation, Red Sox tickets, or a puppy. The reality check booth had students randomly draw a card that had a random expense or reward on it. Some people received $100 speeding tickets or had to lend their friends $50. Others were luckier and were sent $50 from their grandmother.

On top of these booths, the coordinator of the whole event Rich Testa would make random announcement for sales on tickets or furniture. His other announcements would include fines for speeding that cost students Drew Landers and Lillie Morgan $100 each. The fair showed students that we should always be prepared for random things life can throw at us. Julia Hamel said “the surprise drawings of fees was a good reminder of how important it is to have savings to fall back on.”

I found I could live comfortably with the career path I chose and realized you need to be responsible and reasonable when it comes to decisions about purchases.

— Katelyn LaRosa

The importance of a field trip like this is starting to register with students as the number of seniors participating this year was close to double the number of participants last year. At the end of the day, Ms. Daisy asked students some questions about what they learned. It was impressive to see so many student raise their hands when asked if they would have enough money get by. Many students went into the fair comparing their salaries to other students that were making a lot as surgeons or dentists and were taking home nearly $10,000 a month, while they were only bring home $3,000 a month. This was actually a good thing because it had many students making careful decisions with their spending.

Katelyn LaRosa said “I enjoyed credit for life because I found I could live comfortably with the career path I chose and realized you need to be responsible and reasonable when it comes to decisions about purchases.” The fair helped students see that they will be able to support themselves as long as they make smart decisions with their money.

This fair covered the early parts of careers in which you make a smaller salary and don’t make as much as people would expect. Jasmine Stangis said, “The lesson I’d take away from it is that when you start off in a job, even with me being a nurse which is a better paying career, the first few years are still low for salary, and you have to be prepared for that, you have to work your way up to those $100,000 jobs.”

Thanks to this field trip, students now have a better insight into all of the financial responsibilities they will have after high school or college.